About Us

Advertise With Us

RSS Feed | Content Syndication

Terms & Conditions

Privacy Policy

Contact Us

BollywoodShaadis.com © 2026, Red Hot Web Gems (I) Pvt Ltd, All Rights Reserved.

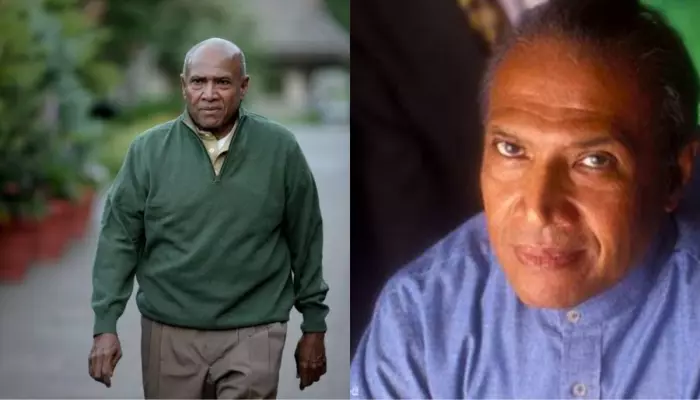

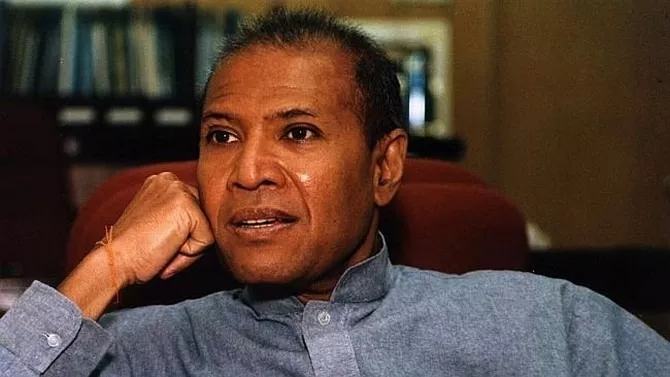

Sri Tatparanandam Ananda Krishnan, often referred to as AK, is a gigantic presence in the world of business in Malaysia with his business acumen and philanthropy stand out. He is the second richest Malaysian. He ranks 93rd on the Forbes Global billionaires list, with a net worth just below $10 billion. The shy Malaysian high-society figure is also known for his extensive network and ability to connect across various circles.

Ananda Krishnan embarked on his entrepreneurial journey by founding MAI Holdings Sdn Bhd, a consultancy firm established in Malaysia. His early success set the stage for opportunities in other sectors, including oil drilling through Exoil Trading, where he landed several major concessions abroad. He also expanded his business acumen into Malaysia’s multimedia and telecommunication sectors.

In the mid-1980s, Ananda gained attention by coordinating the Live Aid concert with Bob Geldof. By the early 1990s, he established himself in multimedia with Maxis Communications and MEASAT. Today, he owns three communication satellites, and his company, Usaha Tegas, invests in telecommunications, media, and oil services. He has also led Astro, MEASAT, and Maxis to industry leadership.

Even though Ananda has a comparatively low public profile, he is also a well-known philanthropist who directs funds to diverse charitable causes through his YCF charitable foundation. His philanthropic work has spanned education, arts, sports, and humanitarian causes. As a businessman, Ananda’s spirit of philanthropy speaks to his commitment to the greater good of society and development.

His philanthropy has also added a dimension to his entrepreneurship by ensuring that his immense wealth benefits humanity. Every philanthropic action he has taken in education, supporting the arts, or human healthcare has guaranteed that he will leave the world with a rich, innovative sense and a constant do-gooder.

Continue reading below

Krishnan viewed India’s surging marketplace as critical to the future of his empire, and he was more than willing to invest the sum necessary to make Aircel a success. It was meant to serve as the capstone of Malaysian tycoon T Ananda Krishnan's five-decade career.

However, his $7 billion bet on mobile carrier Aircel Ltd might instead become the largest foreign investment failure in India. This development illustrates that business is often much messier in India's rapidly growing economy than it looks. While Krishnan had more than the means, he did not realize how vicious a fight it would become in India’s telecom market. With nearly a dozen participants fighting for a market share, call rates in India were reduced to some of the lowest in the world.

Since 2016, the price of established networks has reached the prohibitive pricing of established regional networks like Maxis Communications Bhd. and TV service provider Sun Direct, owned by India’s richest man, which is free calls. With a desire to achieve critical mass and, ultimately, profitability, Aircel made a last effort to achieve mass by attempting a merger with Reliance Communications Ltd.

However, due to complications in the market, a major setback occurred in January 2017 when India’s highest court barred Aircel from selling or leasing its airwaves related to a broader graft lawsuit. The transaction, planned for October, eventually fell off in 2018.

What are your thoughts on AK's journey? Let us know!

Also Read: Mukesh Ambani's Bold Lessons That Made Him India's Richest Person With Rs. 7.65 Lakh Crore Net Worth

advertisement

advertisement

advertisement